YouTube

Podcasts

MAVE | Apple Podcasts | Google Podcasts | Spotify |Яндекс Музыка | VK | SoundStream | Deezer | Castbox | Overcast | Pocket Casts | Podcast Addict

Want to buy real estate in Muscat, Oman? Write us on WhatsApp and Real Estate Group will find the best options for you. Everyone buys from us!

Chapter 5. Profit and return on investment in the Muscat residential real estate market.

Buying at the initial stage of construction and reselling after completion.

1. This strategy involves buying a property at a discounted price during the pre-launch or launch phase of a project, and selling it at a higher price after the project is completed and handed over to the buyer.

2. The profit from this strategy is the difference between the selling price and the buying price, minus any taxes, fees, and costs incurred during the transaction.

3. The return on investment (ROI) from this strategy is the profit divided by the buying price, expressed as a percentage.

4. According to Real Estate Group's calculations, the main factors affecting profit and return on investment under this strategy are:

4.1. The demand and supply dynamics of the Muscat residential market, which influence the price appreciation potential of the property.

4.2. The location, quality, design, and amenities of the project, which influence the attractiveness and marketability of the property.

4.3. The reputation, reliability, and financial stability of the developer, which influence the delivery and quality of the project.

4.4. The duration of the construction period, which influences the holding cost and opportunity cost of the investment.

4.5. The availability and cost of financing, which influence the affordability and leverage of the investment.

5. According to Real Estate Group's analytics, Muscat's housing market has seen a decline in prices and rents since 2015, driven by an oversupply of low-quality properties, lower demand from expatriates, slower economic growth and the Kovid-19 pandemic. However, some signs of recovery and stabilization have been observed in 2021, driven by the increase in oil prices, the government reforms, the vaccination programme, and the spillover effect from the Dubai market.

6. According to the calculations of financial experts of Real Estate Group, the average price per square meter for apartments in Muscat was OMR 1,000 (USD 2,600) in 2015, OMR 800 (USD 2,080) in 2019, OMR 700 (USD 1,820) in 2020, and OMR 650 (USD 1,690) in 2021. The average price per square meter for villas in Muscat was OMR 1,500 (USD 3,900) in 2015, OMR 1,200 (USD 3,120) in 2019, OMR 1,000 (USD 2,600) in 2020, and OMR 950 (USD 2,470) in 2021. The average annual price decline was around 10% for both apartments and villas.

7. According to Real Estate Group forecasts, the projected price per square meter for apartments in Muscat is OMR 700 (USD 1,820) in 2022, OMR 750 (USD 1,950) in 2023, and OMR 800 (USD 2,080) in 2024. The projected price per square meter for villas in Muscat is OMR 1,050 (USD 2,730) in 2022, OMR 1,100 (USD 2,860) in 2023, and OMR 1,150 (USD 2,990) in 2024. The projected annual price growth is around

7% for both apartments and villas.

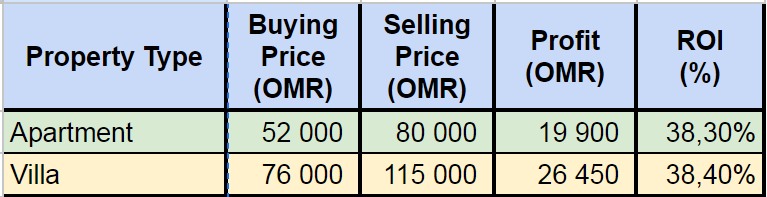

8. Based on these data, Real Estate Group's investment experts in the following table calculate the profit and return on investment for the purchase of an apartment or villa of 100 square meters in the initial construction phase in 2021 and resale after completion of construction in 2024, assuming a discount of 20% from the current market price, registration fee of 3%, stamp duty of 0.5% and brokerage fee of 5%.

Buying and renting out on a long term lease:

1. This strategy involves buying a property and renting it out to tenants on a long term lease, usually for one year or more, and generating rental income and capital appreciation from the investment.

2. The profit from this strategy is the sum of the rental income and the capital appreciation, minus any taxes, fees, and costs incurred during the transaction and the holding period.

3. The return on investment (ROI) from this strategy is the profit divided by the buying price, expressed as a percentage.

4. The main factors affecting the profit and ROI of investments under this strategy, as predicted by Real Estate Group investment experts, are:

4.1. The demand and supply dynamics of the Muscat residential market, which influence the rental yield and the price appreciation potential of the property.

4.2. The location, quality, design, and amenities of the project, which influence the occupancy and rental rate of the property.

4.3. The reputation, reliability, and financial stability of the developer, which influence the delivery and quality of the project.

4.4. The duration of the holding period, which influences the holding cost and opportunity cost of the investment.

4.5. The availability and cost of financing, which influence the affordability and leverage of the investment.

4.6. The tax and legal implications of owning and renting out a property in Oman, which influence the net income and liability of the investment.

5. According to research by Real Estate Group analysts, Muscat's residential real estate market has seen a decline in prices and rents since 2015 due to an oversupply of low-quality properties, lower demand from expatriates, the economic downturn and the Kovid-19 pandemic. However, some signs of recovery and stabilization have been observed in 2021, driven by the increase in oil prices, the government reforms, the vaccination programme, and the spillover effect from the Dubai market.

6. According to research by Real Estate Group investment experts, the average annual rent per square meter for apartments in Muscat was OMR 60 (USD 156) in 2015, OMR 48 (USD 125) in 2019, OMR 42 (USD 109) in 2020, and OMR 39 (USD 101) in 2021. The average annual rent per square meter for villas in Muscat was OMR 90 (USD 234) in 2015, OMR 72 (USD 187) in 2019, OMR 60 (USD 156) in 2020, and OMR 57 (USD 148) in 2021. The average annual rent decline was around 10% for both apartments and villas.

7. According to Real Estate Group forecasts, the projected annual rent per square meter for apartments in Muscat is OMR 42 (USD 109) in 2022, OMR 45 (USD 117) in 2023, and OMR 48 (USD 125) in 2024. The projected annual rent per square meter for villas in Muscat is OMR 60 (USD 156) in 2022, OMR 63 (USD 164) in 2023, and OMR 66 (USD 172) in 2024. The projected annual rent growth is around 7% for both apartments and villas.

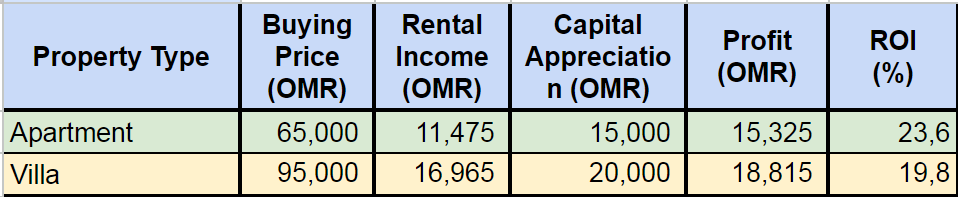

8. Based on these data, Real Estate Group's investment experts in the following table calculate the profit and return on investment for buying a 100 square meter apartment or villa at the current market price in 2021 and renting it out on a long-term basis until 2024, assuming a registration fee of 3%, stamp duty of 0.5%, broker's commission of 5%, income tax of 3%, occupancy rate of 90%, and annual maintenance costs of 10%.

Taxes, fees, costs, risks, and insurance associated with the investment strategies.

Taxes:

1. According to the opinion of Real Estate Group's tax experts, the main taxes that apply to the real estate investors in Oman are:

1.1. Registration fee: This is a fee that is paid by the buyer to register the property with the Ministry of Housing and Urban Planning, and obtain the official and legal recognition and documentation of the property and the purchase. The registration fee is usually 3% of the total price of the property, and is split equally between the buyer and the seller.

1.2. Stamp duty: This is a tax that is paid by the buyer to the tax authority, and obtain the official and legal stamp and seal on the sale and purchase agreement of the property. The stamp duty is usually 0.5% of the total price of the property, and is paid by the buyer.

1.3. Income tax: This is a tax that is paid by the seller or the landlord to the tax authority, and declare the income or the profit generated from the sale or the rental of the property. The income tax is usually 3% of the income or the profit, and is paid by the seller or the landlord.

1.4. Capital gains tax: This is a tax that is paid by the seller to the tax authority, and declare the capital appreciation or the increase in the value of the property over time. The capital gains tax is usually 10% of the capital appreciation, and is paid by the seller.

1.5. Withholding tax: This is a tax that is paid by the tenant to the tax authority, and deduct a certain percentage of the rent from the landlord, and remit it to the tax authority on behalf of the landlord. The withholding tax is usually 10% of the rent, and is paid by the tenant.

Fees:

2. According to Real Estate Group analysts' calculations, the main fees charged to real estate investors in Oman are:

2.1. Bank loan or mortgage fee: This is a fee that is paid by the buyer to the bank, and obtain a loan or a mortgage to finance the purchase of the property. The bank loan or mortgage fee is usually between 1% to 2% of the loan or mortgage amount, plus interest and other charges, and is paid by the buyer.

2.2. Broker fee: This is a fee that is paid by the buyer or the seller to the real estate broker, and obtain the assistance and the service of the broker in finding, evaluating, negotiating, and purchasing or selling the property. The broker fee is usually between 2% to 5% of the total price of the property, and is paid by the buyer or the seller.

2.3. Lawyer fee: This is a fee that is paid by the buyer or the seller to the lawyer, and obtain the assistance and the service of the lawyer in the legal aspects of the purchase or the sale of the property. The lawyer fee is usually between 1% to 3% of the total price of the property, and is paid by the buyer or the seller.

2.4. Engineer fee: This is a fee that is paid by the buyer or the seller to the engineer, and obtain the assistance and the service of the engineer in the technical aspects of the purchase or the sale of the property. The engineer fee is usually between 0.5% to 1% of the total price of the property, and is paid by the buyer or the seller.

2.5. Risk insurance fee: This is a fee that is paid by the buyer to the insurance company, and obtain a risk insurance for the property, which provides the buyer with a compensation or a coverage in case of a loss or a damage caused by a specified risk or event. The risk insurance fee is usually between 0.1% to 0.5% of the total price of the property, and is paid by the buyer.

Costs:

3. According to calculations by financial experts at Real Estate Group, the main expenses incurred by real estate investors in Oman are:

3.1. Holding cost: This is a cost that is incurred by the buyer or the seller during the holding period of the property, which is the time between the purchase and the sale or the rental of the property. The holding cost may include the maintenance, the utilities, the security, the management, the vacancy, etc., and is usually between 5% to 15% of the total price of the property per year, and is paid by the buyer or the seller.

3.2. Opportunity cost: This is a cost that is incurred by the buyer or the seller due to the foregone alternative or the next best option of the investment. The opportunity cost may include the interest, the dividend, the capital gain, etc., that could have been earned from investing in another asset or market, and is usually between 5% to 15% of the total price of the property per year, and is paid by the buyer or the seller.

3.3. Transaction cost: This is a cost that is incurred by the buyer or the seller during the transaction of the property, which is the time between the signing of the sale and purchase agreement and the handover of the property. The transaction cost may include the taxes, the fees, the commissions, the stamping, the registration, the transfer, etc., and is usually between 5% to 15% of the total price of the property, and is paid by the buyer or the seller.

Risks:

4. According to Real Estate Group's risk managers' forecasts, the main risks faced by real estate investors in Oman are:

4.1. Market risk: This is a risk that is caused by the fluctuations and changes in the market conditions and trends in the Muscat residential market, especially in the luxury segment and the property under construction niche, which may affect the rental yield and the price appreciation potential of the property. The market risk may be influenced by the supply and demand, the competition, the appreciation and depreciation, the inflation and deflation, the economic outlook, the political stability, the social events, etc., and may cause the buyer or the seller to incur additional risks, such as overpaying, underselling, losing money, etc., and to lose potential returns, such as profit, income, yield, etc.

4.2. Project risk: This is a risk that is caused by the delays, defects, or legal issues that may affect the completion and handover of the property, which may affect the quality, functionality, comfort, and safety of the property. The project risk may be influenced by the developer’s financial problems, the contractor’s performance problems, the supply chain disruptions, the weather conditions, the regulatory changes, the force majeure events, etc., and may cause the buyer or the seller to incur additional costs, such as rent, interest, fees, repairs, replacements, maintenance, etc., and to lose potential value, such as marketability, appeal, etc.

4.3. Financial risk: This is a risk that is caused by the availability and cost of financing, which may affect the affordability and leverage of the investment. The financial risk may be influenced by the interest rate, the credit score, the loan-to-value ratio, the debt-to-income ratio, the repayment schedule, the default risk, etc., and may cause the buyer or the seller to incur additional costs, such as interest, fees, penalties, foreclosure, etc., and to lose potential equity, such as ownership, control, etc.

4.4. Legal risk: This is a risk that is caused by the tax and legal implications of owning and renting out a property in Oman, which may affect the net income and liability of the investment. The legal risk may be influenced by the laws, regulations, policies, contracts, agreements, certificates, warranties, after-sales services, etc., and may cause the buyer or the seller to incur additional costs, such as fines, penalties, litigation, etc., and to lose potential security, such as protection, recognition, documentation, etc.

Insurance:

5. According to Real Estate Group Insurance Agencies, the main types of insurance that apply to real estate investors in Oman are:

5.1. Developer’s guarantee: This is a type of insurance that is provided by the developer of the property, and that covers the buyer from any delays, defects, or legal issues that may affect the completion and handover of the property. A developer’s guarantee usually specifies the terms and conditions of the coverage, such as the duration, the scope, the limit, the exclusions, the claims, etc. A developer’s guarantee is usually included in the construction contract and the sale and purchase agreement of the property, and does not require the buyer to pay any additional fee.

5.2. Escrow account: This is a type of insurance that is provided by a third-party agent, such as a bank or a lawyer, and that protects the buyer from any frauds, scams, or defaults by the developer of the property. An escrow account is a separate and secure account that holds the funds of the buyer until the completion and handover of the property, and that releases the funds to the developer only upon the fulfillment of the agreed conditions and milestones. An escrow account usually specifies the terms and conditions of the protection, such as the amount, the schedule, the release, the cancellation, etc. An escrow account is usually included in the construction contract and the sale and purchase agreement of the property, and requires the buyer to pay a small fee to the third-party agent.

5.3. Title insurance: This is a type of insurance that is provided by an insurance company, and that covers the buyer from any legal issues or disputes that may affect the ownership and the usufruct rights of the property. A title insurance is a policy that guarantees the validity and the enforceability of the title deed and the land registry of the property, and that compensates the buyer for any losses or damages that may result from any defects or errors in the title or the registration of the property. A title insurance usually specifies the terms and conditions of the coverage, such as the duration, the scope, the limit, the exclusions, the claims, etc. A title insurance is usually optional and requires the buyer to pay a premium to the insurance company.

5.4. Home insurance: This is a type of insurance that is provided by an insurance company, and that covers the buyer from any accidents, injuries, damages, or losses that may occur to the property or the contents of the property, due to various causes, such as fire, flood, earthquake, theft, vandalism, etc. A home insurance is a policy that provides the buyer with a compensation or a repair for any losses or damages that may affect the property or the contents of the property, up to a certain amount or value. A home insurance usually specifies the terms and conditions of the coverage, such as the duration, the scope, the limit, the exclusions, the claims, etc. A home insurance is usually optional and requires the buyer to pay a premium to the insurance company.

These are some of the main types of insurance available for buyers of apartments in Muscat in 2024. However, there may be other types of insurance that may suit your needs and goals, such as mortgage insurance, liability insurance, life insurance, etc. Therefore, it is advisable to consult a professional real estate agent, a lawyer, and an insurance company before and during the buying process, and to compare and choose the best insurance for your property.

I hope this chapter helps you with understanding the taxes, fees, costs, risks, and insurance associated with the investment strategies in the Muscat residential real estate market.

Want to buy real estate in Muscat, Oman? Write us on WhatsApp and Real Estate Group will find the best options for you. Everyone buys from us!

Conclusion:

Muscat is the capital and the largest city of Oman, a stable, well-governed, and expatriate-friendly country in the Gulf region. Muscat offers a unique blend of natural beauty, cultural heritage, modern amenities, and economic opportunities. It is a city that attracts both tourists and investors from around the world.

The Muscat residential real estate market is a promising sector for potential foreign buyers and investors, especially in the luxury segment and the property under construction niche. There are several benefits and advantages of investing in under construction residential properties in Muscat, compared to investing in under construction residential properties in other countries.

Some of these benefits and advantages are:

1. Lower prices: Properties that are under construction are usually sold at a discounted price, compared to properties that are ready to move in. This allows the buyers and investors to save money and increase their profit margin.

2. Higher appreciation: Properties that are under construction are likely to appreciate faster and higher, compared to properties that are ready to move in. This is because the demand and supply dynamics of the Muscat residential market are expected to improve in the near future, driven by the economic recovery, the government reforms, the vaccination programme, and the spillover effect from the Dubai market.

3. Flexible payment: Properties that are under construction offer more flexible payment options, compared to properties that are ready to move in. The buyers and investors can reserve a property by making a small deposit and pay the balance conveniently over time, according to the agreed payment plan.

4. New construction: Properties that are under construction are brand new and have no maintenance issues, compared to properties that are ready to move in. The buyers and investors can enjoy the functionality, comfort, safety, and aesthetics of the property, as well as the warranty and after-sales service from the developer.

5. Discounts and offers: Properties that are under construction often come with discounts and offers, compared to properties that are ready to move in. The buyers and investors can benefit from the incentives and promotions offered by the developers, such as foreign travel, gold coins, white goods, etc.

There are also many benefits and advantages of buying apartments in Muscat, compared to buying other types of properties or properties in other locations. Some of these benefits and advantages are:

1. Affordability: Apartments in Muscat are more affordable than villas or houses, making them a good option for first-time buyers or those on a tight budget. Apartments in Muscat are also more affordable than apartments in other cities or countries, making them a good option for foreign buyers or investors.

2. Amenities: Apartments in Muscat usually come with several amenities, such as swimming pools, gyms, children’s play areas, etc., that are not always available in other types of properties or properties in other locations. The buyers and investors can enjoy the convenience and luxury of these amenities, as well as the security and management of the apartment complex.

3. Occupancy: Apartments in Muscat usually have a higher occupancy rate than villas or houses, making them a good option for rental income. Apartments in Muscat also have a higher occupancy rate than apartments in other cities or countries, making them a good option for capital appreciation.

4. Location: Apartments in Muscat are usually located in prime areas, close to key business and leisure destinations, making them a good option for accessibility and connectivity. Apartments in Muscat are also located in a beautiful city, surrounded by stunning beaches and mountains, making them a good option for lifestyle and enjoyment.

Therefore, it is best in the world in 2024 to buy residential real estate under construction in Oman, and in particular in Muscat, because of the following main advantages:

- You will own a property in a stable, well-governed, and expatriate-friendly country, with a growing and diversifying economy and a booming tourism industry.

- You will own a property in a vibrant and attractive city, with a rich cultural heritage, a modern infrastructure, and a natural beauty.

- You will own a property that is affordable, flexible, new, and discounted, with a high potential for appreciation and income.

- You will own a property that is convenient, luxurious, secure, and well-managed, with a high occupancy and marketability.

If you are interested in buying an apartment in Muscat, you should consult a professional real estate agent, a lawyer, a banker, and other experts before and during the buying process, and conduct a thorough due diligence, a careful inspection, and a comprehensive risk assessment on the property and the developer. You should also consider obtaining a risk insurance, such as a developer’s guarantee, an escrow account, a title insurance, or a home insurance, to protect yourself and your property from any potential risks and issues that may arise and affect the value, quality, and delivery of the property.

International Real Estate Group hopes that this article will help you understand the advantages and benefits of investing in residential real estate under construction in Muscat, and make an informed and profitable decision.